Get the new Broadcom AVGO stock analysis – full technical breakdown, peer analysis against Nvidia and AMD and analyst insights. Get to know why AI demand and individual chip deals are contributing to the bullish run by AVGO.

Highlights of Market, 5 September 2025.

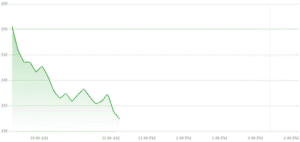

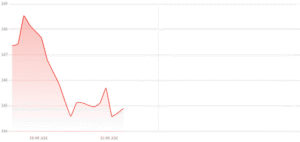

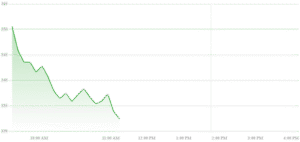

Today’s Movement

Broadcom shares are at about 332.37 in a trading range of 323.00-357.15 after an incredible rise with strong AI hype and earnings expectations.

Earnings & AI Boom

- Broadcom reported revenue of $15.95 billion in fiscal Q3 2025, which is higher than expected, and adjusted earnings per share of 1.69, which is better than expected.

- AI semiconductor revenue increased in year on year basis by 63% to 5.2 billion, but is expected to grow to 6.2 billion in Q4.

- They further project Q4 revenue to be around 17.4 billion, which is higher than the average estimate of Wall Street at around 17.01 billion.

Major AI Order & Industry Buzz

- And in fact, Broadcom is likely to experience a significant level of confidence in the capabilities of their AI-based chip by the fact that OpenAI allegedly placed a $10 billion order.

- Combined with earnings, this deal sent shares up 10-15 percent across trade sessions.

Analyst Sentiment & Price Targets.

- Analysts answered with eagerness:

o Stacy Rasgon lowered target to $400, and rated it Outperform.

o CFRA increased price target to 380.

o Other companies (KeyBanc, Truist, TD Cowen, Piper Sandler) had also raised targets in the $365 to 400 range.

Technical Indicators

- The stock seems to have broken out of a symmetrical triangle formation, which is a bullish indication, with the estimated measured move to be up to $349 assuming the breakout is successful.

- Critical levels of support to observe: $282, $265 and possibly 247 in the event of a correction.

Year-to-Date Performance

- AVGO is up as much as 32-51 YTD, depending on the source of data.

- The stock has increased more than twofold during the last 52 weeks.

| Aspect | Insight |

| Profit & Revenue | Q3 results exceeded expectations; AI revenue growing strongly |

| Outlook | Upbeat Q4 forecast, large AI orders (OpenAI headline) |

| Stock Reaction | Price surged 10–15%; moving into record-high territory |

| Analyst Sentiment | Price targets now ranging $365–$400+ |

| Technical Setup | Bullish breakout from consolidation pattern |

| Risks | Watch for pullbacks—key support levels offer guidance |

Next Steps & Considerations

- Watch Q4 Results — With further AI revenue expansion expected, future earnings will play a critical role in keeping the momentum going at Broadcom.

- Follow Technical Levels — As long as the stock remains above approximately $349, it may be an indication of further upside; a drop down to the 282-265 range may provide entry points.

- Monitor AI News — With any formal announcement or expansion of the OpenAI chip deal, there will be increased investor sentiment.

- Test Volatility – When the implied volatility is substantially elevated (as during earnings time), shorter-term hedged instruments such as cash-secured puts may provide exposure.

| Company | Strengths | Risks/Concerns |

| Nvidia | Market leader in AI GPUs; highest margins; strong IP and ecosystem | High valuation; some production constraints, export risks |

| AMD | Competitive pricing; growing GPU/AI line (MI, etc.); valuation edge | Execution risk; conversion of trials to volume |

| Broadcom | Custom ASIC capabilities; diversified revenue; software/networks | Elevated valuation; must sustain beat-and-raise performance |

Conclusion

Broadcom (AVGO) is now on a strong AI-tailored wave, with a robust revenue stream, an OpenAI alliance worth 10b and positive technical indicators driving investor confidence. Nvidia is the unquestioned leader in GPUs and the promising contender is AMD, but Broadcom has built an unusual competitive advantage in the semiconductor industry through its custom ASICs, leadership in networking, and balanced revenue base. The analysts remain massively on a Buy side and price objectives are moving to the upside of $365-400. The most important question that investors will need to consider is whether Broadcom will be able to maintain its momentum past the key resistance levels and remain ahead of the pack in the AI chip race.

Also read- Nvidia stock

1 thought on “Broadcom AVGO stock”