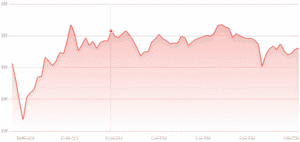

It became the first test of investor appetite by Nvidia stock since the mass AI-stock selloff of last week, in its financial report, In the second quarter chipmaker Nvidia registered the highest sales record, exceeding Wall Street expectations of artificial intelligence chips.

Nvidia Stock — In the News

- Q2 Earnings: Big Numbers, Tepid Reaction

- Nvidia also released good fiscal 2026 second-quarter results with revenue of 46.7 billion (increased by 56 percent a year) and a net income of 26.4 billion (increased by 59 percent).

- Adjusted EPS reported was between 1.05 and 1.08 and it was above expectations.

- Its data-center revenue the AI-driven powerhouse segment slightly beat analysts estimates of at 41.1 billion.

- Stock Reaction: Sell-Off in After-Hours

- In-spite of the good performance, Nvidia shares had gone down by about 3-3.5 percent in the after–hours trading as investors responded to the underperforming data center results and the pessimistic future.

- Forward Guidance & Buyback Plan

- Nvidia projected Q3 revenue of 54 billion (2-percent variation), not at the very high end, but in the same direction.

- Another signal of confidence in the company’s own valuation was a further $60 billion share buyback authorization that the company gave.

- China Exposure: A $50 B Opportunity

- The CEO Jensen Huang also emphasized that China was a $50 billion opportunity and that the current revenue guidance does not forecast data center sales to China including those of the specialized H2O chip.

- Nvidia did not sell any H20 chips to China in Q2, but it did enjoy a release of reserved inventory worth $180 million.

- Valuation Concerns

- Nvidia is now the richest corporation globally, and it has a valuation of more than 4.4 trillion.

- Its forward P/E ratio is approximately 34×, which is higher than the Nasdaq average of 28×, but reduced compared to its high of approximately 63/E in 2023.

- Some analysts warn of a potential AI bubble or overvaluation, but a number of them are optimistic about longer-term demand.

| Aspect | Key Detail |

|---|---|

| Revenue & Earnings | Strong Q2 numbers; revenue: $46.7B; EPS: ~$1.05–1.08 |

| Stock Reaction | Dropped ~3% post-earnings despite strong results |

| Outlook | Q3 guidance of ~$54B; added $60B for buybacks |

| China & H20 Chips | No China sales flagged; large potential if restrictions ease |

| Valuation | $4.4T+ market cap; forward P/E ~34×; some bubble concerns |

China business: upside capped (for now), path re-opening—but foggy

- Guidance excludes China. Nvidia’s Q3 (fiscal Q3 FY26) outlook explicitly assumes zero H20 sales into China, reflecting ongoing licensing and policy uncertainty. That’s the biggest immediate drag on “re-acceleration” hopes for China revenue.

- Licensing/“15%” arrangement: Reports indicate a U.S. export-license framework that would allow certain China shipments with an effective ~15% levy, which would compress gross margin on those sales if/when they resume. Nvidia hasn’t included any of that in near-term guidance.

- Beijing pushback: Chinese regulators have cautioned local firms on H20 purchases, while simultaneously encouraging domestic alternatives—another reason Nvidia is keeping China out of the guide.

- What could change the narrative: Nvidia reportedly has a China-specific Blackwell-derivative (B30A) in discussion with U.S. regulators; formal approval would unlock a fresher product than H20 and could restart a meaningful China run-rate. Timing remains uncertain.

Bottom line (China): Neutral to slightly negative near-term; optionality medium-term. Guidance conservatism plus policy overhang keep China as call-option upside rather than base-case contribution.

AI-sector sentiment: strong demand, cooler mood

- Print beat; reaction meh. Revenue/EPS topped estimates, but data-center came in just light, and stock traded lower after hours—tempering the “AI everything” risk-on tone.

- Guide still robust. Q3 revenue guide (~$54B ±2%) signals hyperscaler demand is intact; the market’s wobble looks more about expectations reset and China uncertainty than end-market weakness.

- Macro read-through: Broader equity markets were already bracing for Nvidia as the key sentiment catalyst this week; the mixed reaction likely cools near-term AI euphoria without changing the secular story.

Bottom line (sentiment): Still bullish long-term AI capex; near-term multiple compression risk if policy noise lingers and data-center beats are narrower.

Stack-up vs peers

Versus AMD (data-center GPUs)

- Product cadence: AMD is shipping MI325X (HBM3E up to 256GB) and guiding MI350 (2H25) with larger HBM footprints; MI400/“Helios” teased for 2026. This keeps competitive pressure on Nvidia in memory-heavy inference/training SKUs.

- Share dynamics: Nvidia still commands the lion’s share of AI accelerators today, but AMD’s improving hardware + ROCm stack means more second-source wins—especially where total cost per token and memory capacity dominate. (Market-share percentages vary by source; Nvidia remains far ahead.)

Takeaway: AMD is a fast-improving #2. The moat of Nvidia is platform scale (CUDA/Networking/Systems), which, however, in the case of some workloads, narrows the gaps in memory-rich AMD parts until the end of 2025.

Versus TSMC (supplier risk/capacity)

- Packaging is the chokepoint. Nvidia’s volumes hinge on TSMC’s CoWoS advanced packaging. Capacity has expanded sharply in 2024–2025 and continues to scale into 2026, but it remains the primary supply governor for Blackwell ramps.

- Shift to CoWoS-L. Jensen Huang flagged a migration from CoWoS-S → CoWoS-L for Blackwell, boosting throughput/performance; Hopper continues on CoWoS-S during the transition.

- TSMC fundamentals: AI demand drove record TSMC revenue/profit in Q2’25; investors should treat TSMC as a levered play on Nvidia (and AMD) AI cycles and on packaging scarcity easing over 2025–2026.

Takeaway: TSMC isn’t a competitor; it’s Nvidia’s critical throughput enabler. Any CoWoS hiccup (or tariff/currency headwinds) can cap Nvidia upside; conversely, continued ramps de-bottleneck supply into 2026.

Quick investor to-dos-

- Model China as zero near-term; add a staged scenario for B30A approval and H20 resumption with margin haircuts (15% hit on applicable sales).

- Watch AMD product drops (MI350 launch windows, MI325X deployments) for evidence of share creep in inference-heavy or memory-bound workloads.

- Track TSMC CoWoS updates and Nvidia commentary on Blackwell vs Hopper mix—these will tell you how fast Nvidia can convert backlog to revenue.

| Scenario | Revenue Run-Rate (FY26E) | Gross Margin | China Contribution | Key Drivers | Stock Implication |

| Bear | $190B–200B | 73–74% | 0% (no H20/B30A approved) | – Data-center growth slows mid-2026 as hyperscaler digestion kicks in. – AMD MI350/MI400 gain 10–12% share in inference workloads. – CoWoS supply bottlenecks linger into 2026. | Multiple compression (P/E → mid/high-20s). Stock pulls back 15–20% from current levels. |

| Base | $210B–220B | 74–75% | 5–7% rev. contribution (late FY26 partial resumption, discounted ~15% GM hit) | – Blackwell ramps smooth; hyperscaler demand holds. – AMD remains 2nd source but not disruptive. – TSMC expands CoWoS capacity steadily. | Market cap stable $4.2T–$4.5T, P/E ~32–35×. Stock consolidates with moderate upside. |

| Bull | $230B–240B | 75–76% | 10–12% rev. contribution (B30A fully approved by late 2025, strong uptake in China) | – AI capex accelerates further in FY27. – AMD remains niche in ultra-large-memory, Nvidia dominates platform. – CoWoS-L yields better supply, easing constraints. | Market cap pushes $4.8T–$5.0T+. P/E sustained ~35–37×. Stock rallies another 20–25%. |

Investor Takeaways-

- China is the swing factor: Currently modeled as zero in base guidance, but approval of B30A or H20 resumption could add $10B+ upside annualized.

- Margins are resilient unless China resumes (then ~100bps hit due to levies), but still very high by semiconductor standards.

- Peers: AMD is more about keeping Nvidia honest than truly dethroning it, but if AMD’s MI350 adoption is broader than expected, that shifts risk toward the Bear case.

- TSMC supply scaling plays the leading role: when CoWoS capacity ramps linearly, backlog is turned into revenue more quickly, with an advantage to the Bull case.

Also visit- https://iggram.com/

2 thoughts on “Nvidia stock”