Learn what 6.5% PRC (policy repo rate) implies on the home loans, EMIs, fixed deposits, inflation and the Indian economy. Easy to understand practical knowledge.

What the Policy Repo Rate Means to You, Your Loans, and the Economy, 6.5% PRC Explained.

The 6.5% actually does not seem a lot, yet it silently determines your home loan EMI and the grocery prices.

That number, or as it is commonly referred to, PRC, is central to the monetary policies of India. And at this very moment it is more than most folk can imagine.

So what exactly does 6.5% PRC mean? Why has it remained so long the same? but what does it do with your money on the street? Simple and straightforward, let us deconstruct it.

What Is 6.5% PRC?

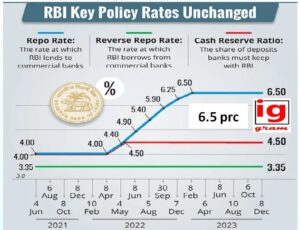

PRC is the Policy Repo rate, which is the interest rate the Reserve Bank of India (RBI) offers where banks borrow short term loans.

In the case of banks, the RBI lends money by pledging the government securities at 6.5% rate. This rate is the support of the interest rate system in India.

In simple terms:

- Borrowing is expensive when the rate of a repo increases.

- When down it makes loans cheaper.

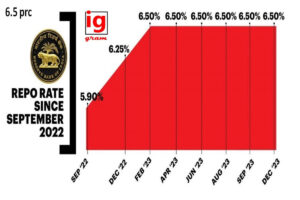

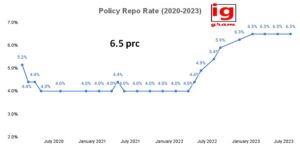

The RBI is currently maintaining the repo rate at 6.5 which is one of the indicators of caution, stability, and regulation of inflation.

Why the RBI Is Holding PRC at 6.5%

There is no chance behind the decision to keep the 6.5% PRC. It is indicative of a balancing exercise.

Key reasons behind the pause:

- Control of inflation is still a priority.

- International oil price and geopolitical insecurities.

- Constant economic growth that is not excessive.

- Stability in currencies with the US dollar.

The message conveyed by the RBI is quite clear, growth is important, but it should not be achieved at the expense of inflation.

The Implication of 6.5% PRC on your life nowadays.

You can follow no announcements of RBI, but you are followed by the policy repo rate, without noise.

- Home Loans and EMIs

Majority of floating-rate loans have a connection with the repo rate.

- A 6.5% PRC means EMIs stay steady

- No emergency relief, no shock either.

- Interest is still higher to new borrowers than it was before 2022.

- Personal and Auto Loans

These loans are sold at a premium by the banks as a result of risk.

- The interest rates are high.

- Power of negotiation is based on credit score.

- Fixed rate options are more appealing at this moment.

- Fixed Deposits and Savings

Here’s the silver lining.

- Increased repo rate = increased FD returns.

- The greatest beneficiaries are senior citizens.

- The rates on savings accounts are low.

PRC and Inflation: 6.5% the Secret Relationship.

The actual enemy here is inflation.

The RBI by maintaining the policy repo rate at 6.5:

- Slows excess borrowing

- Reduces demand pressure

- Prevents the rapid increase of prices.

Of particular importance is the case with essentials such as food, fuel and housing.

The Implications on the Part of Businesses and Startups.

PRC with 6.5% is mixed in the eyes of businesses.

Challenges:

- Higher cost of capital

- Slower expansion plans

- Pressure on profit margins

Opportunities:

- Foreseeable interest climate.

- Easier financial planning

- Stable consumer demand

Never before have startups based on debt financing had to be more strategic.

Is 6.5% PRC Good or Bad?

Depending on the position you are.

Good for:

- Fixed deposit investors

- Inflation control

- Economic stability

Not so good for:

- New borrowers

- Businesses that are highly leveraged.

- Short-term credit users

Essentially, PRC 6.5 is more inclined towards stability than speed.

What might alter the Repo rate in future?

The RBI doesn’t move blindly. A number of drivers may drive the PRC either way:

- Sharp fall in inflation

- Global interest rate cuts

- Economic slowdown

- Major fiscal policy shifts

Hitherto, the anchor is 6.5%.

The Money Plan You Need to Get Right.

There is no panic in the repo rate, so proper planning is important.

Practical tips:

- Only lock long-term loans when the rates are soft.

- Short-term parking Use high-interest FDs.

- Avoid unnecessary debt

- Raise credit rating and bargain low rates.

The opportunity of stability,–when used wisely.

FAQs

- What does 6.5% PRC stand for?

It is defined as the Policy Repo Rate of 6.5 which is charged by RBI to banks in case of lending.

- Are 6.5% PRC home loan EMIs going to fall?

Not immediately. EMIs remain constant, unless when the repo rate is reduced.

- Why is the RBI failing to reduce the repo rate?

The current risks associated with rate cuts are inflation risks and international insecurity.

- Is the 6.5 percent PRC high historically?

It is moderate, increasing compared to the pre-pandemic situation but not as high as the past inflationary highs.

- What is the impact of PRC on fixed deposits?

The increase in repo rate usually results into an improved FD interest rate.

- Is it possible to move above 6.5 percent on the repo rate?

Yes, in case of an inflation spike or a decline in the economic conditions.

Conclusion

The 6.5% Policy Repo Rate (PRC) is much more than a technical number you read in the financial papers and it is a very important lever to control the Indian economy and it directly affects your own finances. This rate means that the Reserve Bank of India (RBI) is indicating a cautious approach between stimulating economic development and ensuring that inflation is tamed. To the borrowers, it affects the home loans, personal loans and the auto loans in a way that it sets the level of your EMIs. It can impact the fixed deposit returns and savings account interest to the savers and provide them with a chance to gain higher returns in a stable rate environment.

In a larger context the 6.5% PRC indicates how the RBI is reacting to economic uncertainties in the world, the fluctuations of currencies, and the inflationary pressures within the domestic economy, and thus it is a very crucial instrument of maintaining economic stability. All businesses, startups, and investors are obliged to pay attention to these rates as they determine the cost of borrowing money, investments, and financial planning in general.

Also read- Best 6- chime premium tier banking features