The Bill Ackman’s main fund doubles to reach $9.2B in 2025 due to returns on Fannie Mae, Freddie Mac, Uber, Brookfield, and Alphabet. But can the rush be maintained–or exposed to change of policy?

Key Facts

- The assets of Bill Ackman have increased to approximately nine point two billion dollars in 2025 as compared to approximately four point three billion dollars in 2024.

- The growth is also attributed to the success of Pershing Square more so because of its investment especially in Fannie Mae and Freddie Mac, which have increased in value significantly.

- Pershing Square Holdings has given nearly 25.3% annualized returns in 2025, and it is performing better in comparison to S&P 500.

an unambiguous and sourced dissection and a no-nonsense overview of sustainability.

1) What other positions had the most contribution (relative contribution / why)

- To summarize, it can be stated that Uber has been one of the largest holdings of the Pershing Square and one of the largest sources of gains during the period outside of the GSEs. Uber is listed as a multi-billion holding (single-digit billions) when it comes to coverage of Q2/2025 filings and reporting. Uber along with a select few large-scale companies have a sizable portion of the Pershing Square public equity exposure.

- Brookfield (and Brookfield-related securities) Another very large position (reported in the top handful of holdings). The Brookfield-related assets have been systematically mentioned in the category of the most significant allocations of Pershing Square and consequently drift the NAV.

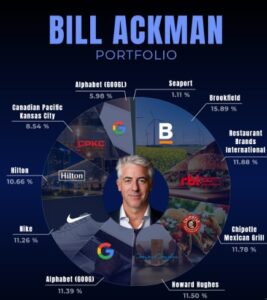

- Alphabet (Google parent) – one of the concentrates in the core-tech portfolio; and together with Uber and Brookfield these names a majority holding of the public-market assets.

- Universal Music Group/Restaurant Brands International/Howard Hughes/other concentrated names – Pershing square retains a few large and high conviction assets (Universal Music Group and Restaurant Brands keep reappearing on portfolio roundups). The individual positions are smaller separately than the GSE stake but significant since the portfolio is highly concentrated (so that stock moves have.

- Private / off-13F and large prior stakes (notes on the transparency) — Sometimes Pershing Square has positions whose full value is not captured in 13F detail or at all but which it holds through PSH (the listed vehicle) than through the hedge fund. That complicates precise sizing of certain positions, which can be determined based on only public filings.

2) What portion of the 2025 improvement was non-Fannie/Freddie?

The press estimates that Fannie Mae and Freddie Mac represented an extremely large portion of Pershing square YTD gains (reports indicate total PSH YTD return was at least 25 percent with GSEs earning a huge portion of the same) Pershing square is believed to have earned some 2B or so on the GSE trade). However, the rest of the gains were related to the concentrated big caps ( Uber, Brookfield, Alphabet, etc.) that constitute a significant portion (some reports claim Uber + Brookfield + Alphabet ≈ 50+% of prominent equity assets).

3) Can this increase be sustained? (advantages, disadvantages, and analysts)

Bull case (why it might be continued)

- Pershing Square is a high-conviction, activist-style and has a number of long-term, large-cap (Uber, Alphabet, Brookfield) positions that can be profitable over a multi-year period. The management has been moving in the direction of permanent capital (PSH) of Berkshire style, which may assist in long-term value capture.

Risks of greatest importance / reasons it may not be a sustainable approach.

- Policy / political risk on Fannie/Freddie. The GSE rally is also fuelled by the speculation of release out of conservatorship and government activities. The stocks are not advised to the risk-averse, analysts warn, any change of policy, massive dilution (e.g., a conversion of senior preferred to common), or slower-than-anticipated recapitalization would wipe out much of the GSE-driven returns. Deutsche Bank and other analysts expressly highlighted situations in which the shares would fall drastically.

- Concentration risk. Single-name or sector shocks tend to move NAV/market price by a significant percentage given there are only a few large positions in it. Various articles mention Uber, Brookfield and Alphabet constitute a large portion of assets, further volatility.

- Market pricing and discount-to-NAV of PSH. Pershing Square Holdings (PSH) is frequently lowering in price to NAV (listing structure, tax/fee considerations) and thus, reducing a shareholder returns, even when underlying assets perform well.

- Event / timing risk. The GSE thesis relies on certain regulatory/political occurrences (e.g. an announced sale to the public, or a formal termination of conservatorship). In case of timing slippage or other disappointing details, the thesis may be weakened quickly.

4) Bottom line (short answer)

Other positions that were of greatest interest: Uber, Brookfield, Alphabet, Universal Music Group, Restaurant Brands and several concentrated names contributed to the non-GSE portion of the gains. Those are sufficient positions to significantly move NAV.

Sustainability: mixed — Pershing Square has concentrated large-cap bets which have a realistic multi-year foundation on returns, however, the majority of the headline doubling is pegged on a politically and regulatorily delicate GSE rally. That renders the recent net-worth spike

contingent weak: in case the government choices or dilution risk comes to pass, a great deal of the upside may be reversed in a short period of time. Analysts recommend caution.

Conclusion

A combination of strong conviction and great concentration is evidenced by the dramatic increase in net worth, of approximately nine point two billion dollars, enjoyed by Bill Ackman in 2025.

Although his long-term bet in Fannie Mae and Freddie Mac paid off with excessively high returns in the short term, his other heavyweight portfolio holders like Uber, Brookfield, Alphabet, and Universal Music Group still remain in the portfolio at Pershing Square. These positions are a stronger base, though they cause Ackman to be susceptible to greater volatility because of their magnitude.

His wealth advancement will be sustainable in the end depending on how the government-sponsored enterprises perform. When political winds change or the gains are diluted through recapitalization plans, the gains might disappear in a span of time as they materialized.

On the contrary, in the event that the reforms go in line with the thesis of Ackman, the rally may serve to solidify his claim as one of the most accurate investors in the history of Wall Street.

The novel is a high-stakes gamble in short, a combination of long-term big-cap investments combined with a speculative trade in politics which might or might not be a redefinition of his present fortunes or a blow-out of his current fortunes.

Also read- The truth about Musk buys shares worth about $1B of Tesla

1 thought on “Proven , Bill Ackman’s main fund doubles to $9.2 billion in 2025”