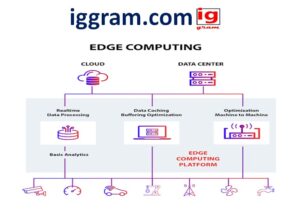

Learn the best trends of edge computing that will revolutionize telco networks in the year 2025. Understand how 5G, AI, and multi-access edge computing (MEC) is transforming the nature of telecom infrastructure, monetization, and business models of the future.

The reason why edge computing is important to telcos.

It is useful to refresh on why edge-computing is becoming such a significant concern in telecommunications before delving into the trends:

- Telcos are being driven out of delivering connectivity and to the provision of compute + connectivity +. Allows the new business model (e.g. enterprise verticals, low-latency applications).

- As the quantity of devices producing data (IoT, sensors, AR/VR, autonomous systems) grows, the processing can be brought nearer to the source (the so-called edge), which contributes to latency, bandwidth reduction, privacy/regulation, and better user experience.

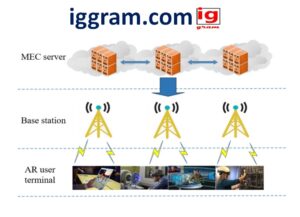

- The 5G/5G-Advanced (and future 6G) with edge infrastructure (also known as multi-access edge computing / MEC) has applications that just had not been possible previously (industrial automation, XR, real-time analytics) within telco networks.

- Since telcos are already in a position to control both some of the aspects of connectivity and the network infrastructure (e.g., base stations, transport, backhaul, core network), they are well positioned to integrate edge compute and monetize edge + network services as opposed to being a dumb pipeline.

Thus in 2025, we will be witnessing a shift: edge ceases to be an experimental tool or a niche and becomes a component of telco network strategy.

Major Trends of 2025 in Telco Edge Computing.

The following are the key trends of edge computing in the telco sector in 2025, their meaning, and significance as well as some of their implications.

-

Edge and real time inference with AI.

- Telcos are also moving AI/ML workloads to the edge instead of transporting all of the data back to central clouds. This helps such things as local analytics, predictive maintenance, autonomous operations (e.g., in manufacturing / logistics) and context-aware services.

- An example is: “Telcos can process data nearer to the source, making faster decisions, due to the combination of 5G and edge computing and empowering it to generate new revenue streams as well as increase efficiency, as claimed in one article.

- Why it is important: Local edge AI has the advantages of low latency, low bandwidth usage cost, and privacy/regulation regulation. Moreover, telcos with the ability to provide the so-called edge AI compute + connectivity might be better positioned to provide value to business clients.

- Implications: Operators must develop/deploy edge compute infrastructure that can be used to run AI workloads( GPUs/accelerators, containerization, orchestration). They will also be required to collaborate with cloud/hyperscaler/AI vendors, operate models lifecycle at the edge, and data governance/localization.

-

Edge + 5G/5G-Advanced + toward 6G

- The deployment of 5G (as well as the migration to 5G-Advanced / initial 6G research) is closely connected with edge computing in telco networks. 5G provides connectivity properties (low latency, high bandwidth, massive devices) which enable many edge applications.

- Indicatively, in one of the sources, mobile networks are mentioned to be progressing to platforms, not just connectivity, through network APIs (enabling edge services).

- And the reason it is important: Edge compute within telco setting cannot provide its full value without the network side (5G/6G and network cloudification) being able to provide ultra-low latency, reliability, and control. In addition, telcos need to redefine network architecture (RAN/cloud/disaggregation) in favor of distributed edge nodes.

- Implications: Telcos need to make investments in network/cloud convergence, distributed cloud architecture (edge nodes at base stations, aggregation points), support network slicing (see below) and interworking with edge compute platforms. They should also monitor standardisation, spectrum and cost of infrastructure.

-

Multi-access edge computing (MEC) + hybrid cloud + edge native apps.

- Telco edge computing is becoming a component of a hybrid approach, not a replacement of the cloud, but rather a supplement. Edge nodes are used to deal with latency-sensitive and local workloads whereas central/cloud deals with heavy compute, aggregation of data, and long-term storage.

- There is the concept of edge-native applications (applications developed to execute on edge infrastructure). In the case of telcos that would entail the construction of applications that presuppose distributed compute and connectivity in the area of the users/devices instead of central only.

- Why it is important: To monetise edge, telcos will have to back both the connectivity and + compute + platform side. Hybrid/cloud/edge architecture provides adaptability and it can support a wide range of use-cases (consumer, enterprise, industrial).

- Implications: Network and IT teams need to eliminate traditional connectivity network, data centres, cloud and edge node silos. Placing workload, orchestrating workload, security of workload in distributed nodes, and lifecycle management become important. Telcos can collaborate with cloud/hyperscaler providers in providing hybrid edge/cloud services.

-

Network monetisation Edge as a service (EaaS), Network-as-a-Service (NaaS) and APIs.

- Among the key questions of the telcos: how to make money out of the investment in edge computing / 5G / MEC. Examples of these models in 2025 include Edge-as-a-Service (EaaS), bundled connectivity + compute + analytics and exposing network capabilities to APIs (NaaS).

- An example is: edge computing is being offered by operators. The monetisation schemes are as follows: pay as you go compute and storage, bundled 5G connectivity and MEC, revenue sharing with hyperscalers on edge application hosting.

- Why it is important: Selling connectivity (data plans) less differentiated. Telecos desire to own greater part of the value chain, and provide more differentiated and higher-valued services, particularly to enterprise/verticals ( manufacturing, logistics, healthcare). That is where network capabilities + edges provide them with an advantage (pun intended).

- Implications: Telcos should develop the business model, packaging, partner ecosystem, pricing processes, SLA definitions, billing and OSS/BSS modifications. Could include the collaboration with hyperscalers, system integrators, vertical industry participants. They will have to scale such services, ensure operational excellence and assure SLAs.

-

Partial security, resilience and regulatory/localisation in the edge.

- The attack surface increases as the compute is spread out to many more nodes (edge). Telcos will have to deal with security and data governance (particular with local/regional workloads), distributed infrastructure resilience (power, cooling, connectivity). Indicatively, one of the articles had mentioned increased edge security as the priority in 2025.

- In addition to this, regulation of data sovereignty/localisation, network access, spectrum, and privacy will have an effect on how edge infrastructure is implemented and operated. Telcos have to sell in the regulatory landscape.

- Why it is important It would have been easy to fail, breach, or obtain a bad reputation without effective security and operational resilience in edge deployments. Enterprise clients will also require high security and compliance in case they are storing workloads locally (their data).

- Implications: Telcos should combine edge nodes, which have secure hardware (trusted compute/secure enclaves), encrypted connections, identity and access control, zero-trust design. The operation processes have to deal with numerous distant nodes. Patching, lifecycle management and monitoring are more complicated. Need to also collaborate with security vendors.

-

Industry/vertical target Industry IoT, AR/VR/XR, autonomous systems.

- A large number of the convincing applications of telco edge are in enterprise/industrial applications: manufacturing (real-time control), logistics, smart cities, AR/VR/XR in media/gaming, autonomous vehicles/robots. The latency, high reliability is possible due to the edge.

- Since 5G is evolving into a business-to-business (B2B) and business-to-everything (B2X) instead of consumer dataplan, edge becomes an important enabler of said services.

- Why it is important: These verticals are better margin opportunities than bulk consumer connectivity. Industrial/enterprise edge service offered by telcos that are capable of winning can open up new revenue.

- Implication: Telcos require vertical specific knowledge, go-to-market tactics, relationships with system integrators and domain professionals. They must create solutions, not only connection + compute, but the entire value-chain (sensors, analytics, apps, edge infrastructure).

-

The evolution of infrastructures Disaggregation, open RAN, and thousands of edge nodes.

- The direction of telco network architecture is disaggregation (software – hardware decoupled), cloud-native functions, open RAN, distributed compute (RAN + transport + edge). The location of edge compute nodes can be in numerous locations: base stations, aggregation points, enterprise locations.

- There is some warning that older OSS/OSS inventory systems might not be able to scale to the number of edge nodes (100K+ nodes) and dynamism.

- Why it is important: Telcos will have to change their infrastructure and operations to provide edge computing on a large scale. In the absence of this development, edge will be niche or costly.

- Implications Notable infrastructure investment, automation and orchestrating structures, convergence of network/clouds operation. Also the transformation of operations (people/process/tools). Telcos can be forced to shut down old resources and re-architecture its network/cloud infrastructure.

-

Cost-effectiveness and sustainability of at the edge deployments.

- The deployment of large numbers of distributed edge nodes brings up power, cooling, space, maintenance, cost issues. Sustainability and cost efficiency is more and more relevant in the telco world. Sustainability is one theme that is highlighted in some of the telco trend forecasts of 2025.

- Reason why: Edge must be cost effective. In the event that the deployment and operation cost of edge nodes are prohibitive, ROI will be negatively affected. Furthermore, telcos are under pressure to lower carbon footprint and energy efficiency.

- Implications Telcos are forced to design energy-efficient edge nodes, use modular nodes where possible, reuse existing infrastructure where possible, automate to reduce OPEX, and investigate revenue models compensating the cost (see monetisation trend above).

-

Scaling the partnerships and the ecosystem.

- Telcos can not accomplish all of this on their own. The edge ecosystem includes hardware (servers, accelerators, and so on), software (edge orchestration, containers, microservices, etc.), hyperscalers/cloud providers, enterprise vertical, systems integrators.

- Both articles, e.g., stated that telcos are becoming more like techcos when they head into partnership with hyperscalers by joining forces on edge + cloud + AI.

- Why it is relevant: The value chain is altering and telcos require to decide with whom to collaborate with (or obtain) and the positioning (connectivity provider or full-stack edge platform consumer).

- Implications: Telcos must develop an ecosystem strategy of buildings the edge: partner or develop internal capabilities, choose what their value captures, what to outsource, what to bundle, etc.

Summary Table of Trends vs Implications

| Trend | Why it matters | What telcos should focus on |

| AI-powered edge / real-time inference | New classes of applications demand low latency and local compute | Build edge infrastructure with AI compute, model lifecycle management, partner for AI/ML |

| Edge + 5G/5G-Adv (and beyond) | Connectivity + edge compute is the basis for new services | Converge network/cloud/edge, invest in distributed architecture, support slicing & RAN/cloud interplay |

| Hybrid cloud + MEC + edge-native apps | Edge is complementing cloud rather than replacing it | Build orchestration, distributed infrastructure, support workloads at edge + cloud |

| Monetisation (Edge as a Service, APIs, NaaS) | New revenue streams beyond connectivity | Develop commercial models, API exposure, partnerships, enterprise go-to-market, billing/OSS changes |

| Security & resilience | Distributed nodes increase complexity & risk | Deploy secure hardware/software, zero-trust architectures, operational processes for many nodes |

| Industry verticals focus | Higher value than pure consumer connectivity | Develop vertical-specific solutions (manufacturing, AR/VR, smart cities), partner with industry players |

| Infrastructure evolution & scale | To support many edge nodes and distributed architecture | Invest in disaggregated architectures, OSS/BSS transformation, operations automation |

| Sustainability & cost-efficiency | Distributed nodes increase cost/power demands | Design energy-efficient nodes, use existing sites where possible, optimize OPEX |

| Ecosystem & partnerships | Value chain complexity demands collaboration | Build strategy for partnerships, clarify telco role in edge ecosystem |

This is what it means to Telco Strategy in 2025.

- Telcos must not look at edge computing as a sidelined activity, but include it in the network roadmap. It overlaps network architecture, go-to-market, OSS/BSS and cloud strategy.

- They should invest in edge: distributed compute and storage infrastructure and operations as well as in orchestration, monitoring, lifecycle management, and security.

- They have to transform the business model: to shift off the sale of connectivity to the sale of a bundle of services (connectivity + compute + platform) to the Enterprise/verticals.

- They must select positioning: Do they offer simple connectivity or complete full-stack digital service providers with the capability to offer edge/AI solutions? The latter is more valued but also more complicated and alliances.

- Composed codes This set outlines ways to ensure ongoing progress in the domain of system engineering through the environment’s implementation of the three intervention types described above at Genvelop and Zenisal Discovery: ecosystem and partnerships.

- Concentrate on scaling down operation and making edge practical: deployment of numerous nodes, automation, effective operations, cost management, security/resilience. Not small pilot projects but scale is needed to realise the economics.

- Be ready to regulatory, security, sustainability limit: All should take into consideration data localisation, privacy, energy usage, distributed node risk, etc.

- Priorities Use-Cases with a significant ROI: e.g. industrial internet of things, augmented reality/VR/XR, smart cities, real-time analytics, autonomous systems. Such use-cases require edge and can result in increased margins.

- Follow new technologies: e.g. integrated sensing + communication (ISAC), open network APIs, move to 6G, new business models around network capabilities (according to four technology trends of Ericsson).

The future: What to expect in 2026 and beyond.

- How fast will telcos develop edge node deployment (hundreds/thousands vs tens)?

- The way price settings of edge services will change (subscription, consumption-based, revenue share)?

- Is this success of the telcos as platform providers (with APIs, network capabilities, edge compute) and more than conduit offerings and networks?

- What will 6G, ISAC, network-sensing and edge convergence do with the game? These were transformative as pointed out by Ericsson.

- What will the mass-market edge demand and revenue most will be produced in what verticals (smart manufacturing, autonomous vehicles, XR, smart cities)?

- What changes would OSS/BSS, operations, and telco culture have to make to serve massively distributed, hybrid (cloud+edge) infrastructure?

- It is always the case that security, data governance, and sustainability will figure in made or broken edge deployments?

Conclusion:

By 2025, edge computing will no longer be merely an experiment of a technical character by telecom operators. It fills the divide between connectivity, cloud, and computation – it allows telcos to change positions in the value chain as bandwidth providers to digital service enforcers.

The combination of 5G/5G-Advanced, AI-driven edge intelligence, and multi-access edge computing (MEC) is changing the way the networks operate and what they are able to provide. New enterprise and consumer experiences are being powered through low latency, localized processing and real time analytics, this is in the fields of industrial automation and autonomous systems, immersive AR/VR, and a smart city infrastructure.

Nevertheless, the opportunity is not free: it is difficult to expand distributed infrastructure, guarantee security and regulatory adherence, regulate energy efficiency, and identify feasible monetization formats, including Edge-as-a-Service or Network-as-a-Service. Telcos need to conquer innovation versus continuous simplicity and sustainability of operations.

The ecosystem will need to work together along with the hyperscalers, cloud providers, AI vendors, and industry experts as no individual actor will possess the advantage. Telcos that are most competitive will be those that master network-cloud convergence, develop edge-native platforms and that offer enterprise-vertical solutions.

Finally, edge computing is no longer doubting the telco business model. The telecom operators who will be winning in the near future will be those that become tech-driven service platforms, making it easy to bind together connectivity, compute and intelligence on the network edge – delivering the next generation of digital applications and experiences.

Also read- Shocking Facts about ios 26

1 thought on “future of edge computing: trends for 2025 in telco networks”